Week In Review

01.30.26

- Fed policy uncertainty rose after President Trump announced Kevin Warsh as his nominee for Fed Chair, putting markets under pressure.

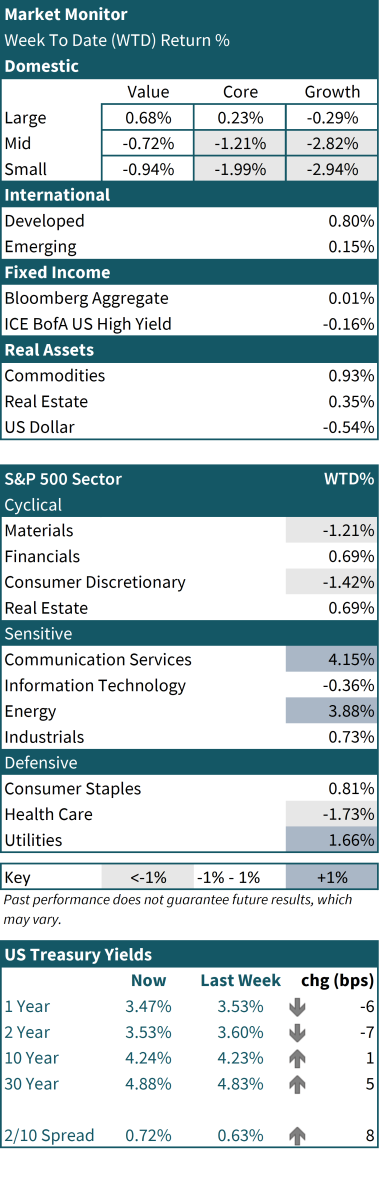

- US equities posted mixed results, as Large Caps outperformed Small Caps and sector leadership was concentrated in Energy, Utilities, and Communication Services.

- Macro data delivered a hotter PPI print, a strong Chicago PMI, and a notable decline in consumer confidence.

- Oil held firm near multi‑month highs while precious metals saw a sharp reversal on Friday as crowded positions unwound.

- Geopolitical tension around Iran remained a key focus, keeping attention on potential supply disruptions.

US equities ended the week mostly lower. The S&P 500 finished slightly positive and the Nasdaq posted modest losses, while the Dow and small caps slipped further. Hotter PPI (producer inflation) data and renewed policy questions offset strong earnings in several Mag 7 bellwethers. Commodities gained overall, led by oil, but precious metals fell sharply on Friday as leveraged long positions unwound. Developed markets outpaced emerging markets.

Market leadership favored Large Caps over Small Caps. Value held a modest edge over Growth. Sector performance was mixed, with Energy and Utilities leading on firmer oil and steady defensive flows, respectively. Communication Services also stood out, supported by a strong week from Meta, which benefited from upbeat revenue guidance and rising engagement tied to AI investments. Consumer Discretionary, Health Care, and Materials lagged. Overseas, developed markets such as Japan and the UK outperformed. Emerging Markets lagged and took a breather after a very strong start to 2026.

Kevin Warsh’s nomination added a new layer of policy uncertainty. He was known as a hawkish governor who focused on upside inflation risks even during the spring of 2008, when inflation was just above 2% and the economy was already sliding into recession with weakening labor conditions. He also opposed the Fed’s early rounds of quantitative easing and criticized balance‑sheet expansion. More recent remarks suggested support for lower rates, but he has offered few specifics. That mix—hawkish history but sparse current guidance—kept markets cautious, particularly on Friday as equities sold off, long-end yields drifted higher, and precious metals reversed earlier week strength.

Earnings produced wide dispersion. Apple reported strong iPhone demand and better margin guidance, though ongoing supply and component‑cost concerns limited its stock reaction. AI‑related capital spending remained elevated across hyperscalers and industrial supply chains. The software sector saw a heavy selloff as competitive pressure and scrutiny of results intensified. Health insurers also experienced a steep drop after regulators signaled far smaller‑than‑expected Medicare Advantage rate increases for 2027.

Macro data sent mixed signals. December producer prices came in hotter than expected, driven by services margins. The Chicago PMI reached its highest level since late 2023. Consumer confidence, however, fell to its lowest reading since 2014, with households more cautious on labor conditions and major purchases. Job‑cut announcements accelerated across major employers, driven by post‑pandemic normalization, efficiency efforts, and rising AI deployment. Industrial‑sector commentary pointed to strong high‑end consumer demand and firm activity in heavy industries, but several companies highlighted input‑cost pressure, tariff impacts, and uneven business spending.

Geopolitical risk kept oil near five‑month highs as markets tracked potential US action against Iran. Diplomatic signals eased fears of an immediate strike, but the US naval buildup and Iran’s planned drills in the Strait of Hormuz kept attention on shipping risk and possible supply disruption. Talks through regional intermediaries suggested both sides were seeking to avoid escalation, yet the market still treated the situation as fluid.

Looking ahead, next week offers insight across manufacturing, labor, services, and consumer trends. ISM Manufacturing on Monday and ISM Services on Wednesday will provide updated readings on production, orders, and service‑sector momentum. JOLTS, ADP, weekly claims, and Friday’s non‑farm payrolls and unemployment rate print will give a broad view of hiring conditions and wage trends. Consumer sentiment could add clarity on household confidence. Earnings from Alphabet, Amazon, major semiconductor names, and several consumer and payments companies will offer further detail on AI investment cycles, digital‑economy demand, and discretionary‑spending patterns.

Key events to watch next week

FactSet estimates in parentheses unless otherwise noted.

Monday: US ISM Manufacturing PMI (48.3)

Tuesday: US JOLTs Job Openings (7.1M)

Wednesday: US ADP Employment Survey (40k), US ISM Services PMI (53.8)

Thursday: US Initial Claims (210k), US Continuing Claims (1,825k), US Challenger Job Cuts (43k)

Friday: US Non-Farm Payrolls (70k), US Unemployment Rate (4.4%), US Avg Hourly Earnings (m/m: 0.3% | y/y: 3.6%), US University of Michigan Consumer Sentiment (prelim: 55.8)

Past performance does not guarantee future results, which may vary.

Source: FactSet, MidWestOne Private Wealth.

All returns presented are total returns, which include the reinvestment of income and dividends.

For style performance, Large, Mid, and Small for US Equity refer to the Russell 1000, Russell Midcap, and Russell 2000 indices, respectively. Value refers to companies with lower price-to-book ratios and lower expected growth values, and Growth refers to higher price-to-book ratios and higher forecasted growth values. Real Estate refers to the DJ Equity REIT Total Return Index. Commodities refer to the Bloomberg Commodity Index. US Dollar refers to the value of the United States dollar relative to a broad basket of trade-weighted foreign currencies. Developed: MSCI EAFE; Morgan Stanley Capital International Index that is designed to measure the performance of the developed stock markets of Europe, Australasia, and the Far East. Emerging: MSCI Emerging Markets; Morgan Stanley Capital International Index designed to measure the performance of the emerging stock index of China, Brazil, India, and other emerging market countries.

Diversification does not protect an investor from market risk and does not ensure profit.

This material is provided for educational purposes only and should not be construed as investment advice or an offer or solicitation to buy or sell securities. Views and opinions expressed are current as of the date of this publication and may be subject to change, they should not be construed as investment advice.

John McClain

Kong Her

Bill Neal

Tell us about you.

Realize your vision for the future through careful planning, expert guidance and a disciplined, collaborative approach that grows with you and your passions.

Not FDIC Insured | No Bank Guarantee | May Lose Value | Not a Deposit | Not Insured by any Federal Government Agency