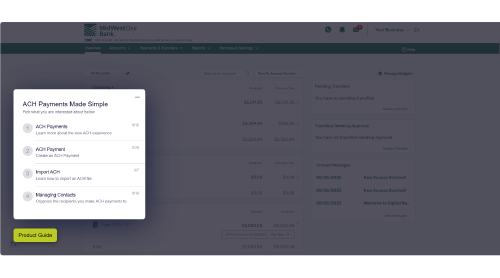

ACH Services

Easily manage and schedule your payments with ACH Services from MidWestOne Bank.

- Make and receive payments from any bank in the country without the hassle or delay of paper checks.

- ACH payments are one of the most efficient methods of managing and controlling your cash flow.

- Have the flexibility to schedule payments in advance or schedule them last-minute.

- By taking advantage of Same Day ACH with MidWestOne Bank, you can have your payment settle the same day.*

*ACH transactions must be received by established cutoff times and be within the maximum dollar amount permitted for Same Day ACH in order to be processed, received, and settled on the same banking day.

Frequently Asked Questions

How long does it take an ACH transfer to process?

MidWestOne Bank offers Same Day ACH origination, which allows you to submit ACH transfers and have them be processed on the same banking day, including being received and posted to the Receiver’s account the same day, as long as the transfer is submitted by the established cutoff times and within the maximum dollar limit permitted by the Nacha Operating Rules. Traditional ACH allows for you to submit ACH transfers that will be received and posted to the Receiver’s account as early as the next banking day.

Will MidWestOne Bank ever contact me regarding the status of my ACH transfers?

Yes, you may be contacted by MidWestOne Bank regarding the status of ACH transfers you submit. We may have to contact you if the results of our fraud anomaly detection indicate there are elevated risk factors. In these situations, we may contact you at our discretion to confirm the payment details before completing the transfer. Please note that MidWestOne Bank will NEVER ask for your login credentials used to access Online Cash Manager during these situations.

What are the cutoff times for submitting ACH files?

Future dated ACH files can be submitted until 5:00 pm CT, and Same Day ACH files can be submitted until 12 pm CT. You must be signed up to originate Same Day ACH files, and entries are subject to the qualifications set forth in the Nacha Operating Rules to be eligible to be processed the same day.

What happens if I submit an ACH transfer that exceeds my daily limit?

ACH files that exceed your daily limit will be rejected by the system. You will receive a message stating the file has exceeded the limit and will not be originated. The users at your company set up to receive email notifications will also receive an email stating the file won’t be originated. Please contact our Treasury Management Support team at 855-696-2265 or tmsupport@midwestone.com to request a temporary limit increase if you have a need to submit an ACH that exceeds your limit. We will contact you to inform you whether the limit increase was approved and if the file can be re-submitted.

How can I stay up to date about ACH Rule changes that impact my business?

MidWestOne Bank sends periodic email newsletters with a brief explanation of upcoming changes to the Nacha Operating Rules that may impact your business, although you can also review information about all upcoming ACH Rule changes on Nacha’s website by clicking here. Additionally, you can sign up to receive news about the ACH Rules by clicking here to access information about the ACH Rules and scrolling to the very bottom of the page. Enter your name, email address, and company name to sign up for free today.

What is the Effective Entry Date?

The Effective Entry Date is the date provided by the Originator of an ACH transaction that indicates the date the company wants to have the payment settled (i.e. the “wish date”) and be posted to the Receiver’s account. The Effective Entry Date will generally be the date the payment will settle if the file is submitted in accordance with established cutoff times, is not a stale dated (i.e. a date that has already passed), etc.

What is Business Email Compromise?

Business Email Compromise (often referred to as "BEC") is one of the most financially damaging online crimes that exploits the fact that so many of us rely on email to conduct business.

Although there are many variations to the types of BEC schemes, most cases involve criminals sending an email message that appears to come from a known source making a legitimate request, like in the examples below:

- An employee sends an email to request a change to their payroll Direct Deposit account information (e.g. a new account and/or routing number).

- A supplier or business partner whom you regularly do business with sends an email to request a change to the account information they have on file for vendor payments (e.g. a new account and/or routing number).

In some cases, malware or malicious software can infiltrate company networks to allow criminals to gain access to legitimate email threads about billing and invoices. Criminals can use this information to time requests or send messages, so accountants or financial officers don’t question payment requests

How can you protect yourself against Business Email Compromise?

Perhaps the single best way to protect against Business Email Compromise is to verify payment and purchase requests in person if possible or by calling the person to make sure it is legitimate using a trusted phone number you have on file, not a phone number included within the email. You should verify any change in account number or payment procedures with the person making the request.

Below are other tips to help protect your business:

- Carefully examine the email address, URL, and spelling used in any correspondence. Scammers use slight differences to trick your eye and gain your trust.

- Be careful what you download. Never open an email attachment from someone you don't know and be wary of email attachments forwarded to you.

- Be especially cautious if the requestor is pressing you to act quickly.

What should I do if I’ve been the victim of Business Email Compromise?

If you recognize you have become the victim of a Business Email Compromise scheme, it’s very important that you act quickly – hours, and even minutes, can make the difference in potential fraud loss recovery efforts. Both ACH and Wire Transfers are typically irreversible, even if fraud is involved.

- Contact MidWestOne Bank to explain what happened so that we can begin remediation and fraud recovery efforts. Our Fraud Services team may request additional information regarding the incident to assist in the investigation and your fraud recovery efforts.

- Notify your organization’s Information Technology (“IT”) or Information Security (“IS”) teams, as it’s possible malware or other malicious software has infiltrated your network.

- Change your email password and add multifactor authentication (MFA).

- Notify your local FBI field office to report the crime. You can find a listing of local FBI field offices on the FBI’s website.

- File a complaint using the FBI’s Internet Crime Complaint Center (“IC3”) portal.