Spend on Fun, Not Fees.

Overdraft Flex service helps you get through the occasional tight spot. With Overdraft Flex you won't pay any overdraft fees on overdrawn balances of $50 or less.*

Contact a Banker to see if your account qualifies for Overdraft Flex Learn more about Overdraft Flex

Add Overdraft Flex to Your Checking

Help avoid overdraft fees with MidWestOne's exclusive Overdraft Flex service.

CONTACT YOUR BANKER

Contacting a banker is easy - Give us a call, stop in a branch or send us a message.

QUALIFY YOUR ACCOUNT

Your banker will work with you to ensure your checking account is set up with all the qualifying conditions including: direct deposits, overdraft protection & OOPS.

SPEND ON FUN, NOT FEES

Keep your budget on track, even with the occasional overdraft - so you can spend more on the fun stuff!

*Your MidWestOne consumer checking account must be enrolled in Occasional Overdraft Protection Service (OOPS), and meet qualifying direct deposit conditions below. Once you are eligible for Overdraft Flex, your consumer checking account must continue to meet the qualifying conditions to maintain your enrollment in the program.

Receive a total of $500 in qualifying direct deposits into your MidWestOne consumer checking account in the previous 35 days. A “Qualifying Direct Deposit” is defined as a direct deposit by ACH transfer of payroll, pension, or government benefits from your employer or a government agency. The recipient’s name associated with such deposits must match the name of the MidWestOne consumer checking account holder. Standard overdraft collection procedures will apply. For additional program details see a banker.

OOPs applies to checks, electronic fund transfers, automatic bill payments and other transactions made using your checking account. We will not include ATM and everyday debit card transactions within OOPS without first receiving your affirmative consent to do so. We typically do not pay overdrafts if your account is not in good standing, you are not making regular deposits or you have excessive overdrafts. Your account will be charged an overdraft fee of $35.00 for each item that overdraws your account in excess of $50.00. An item or transaction that is returned and later represented to us may result in you incurring additional fees, such as multiple nonsufficient funds (NSF) fees each time that item or transaction is presented. We retain full discretion to decline to pay any overdraft item under the OOPS Service for any reason. All negative balances must be resolved within 35 days of the original overdraft. If the negative balance is not resolved within 60 days, your account will be closed.

Financial Education Resources

Helping you on your journey toward financial freedom.

These quick read, easy to use resources will help you stay on top of your finances and keep your financial journey on track:

SIMPLE GUIDE TO BUDGETING

Life is unpredictable and can catch you off guard, use these strategies to effectively manage and pay off your debt.

Understanding credit Scores

Learn the basics about credit scores and how your credit score can affect your financial future.

What is a credit score?

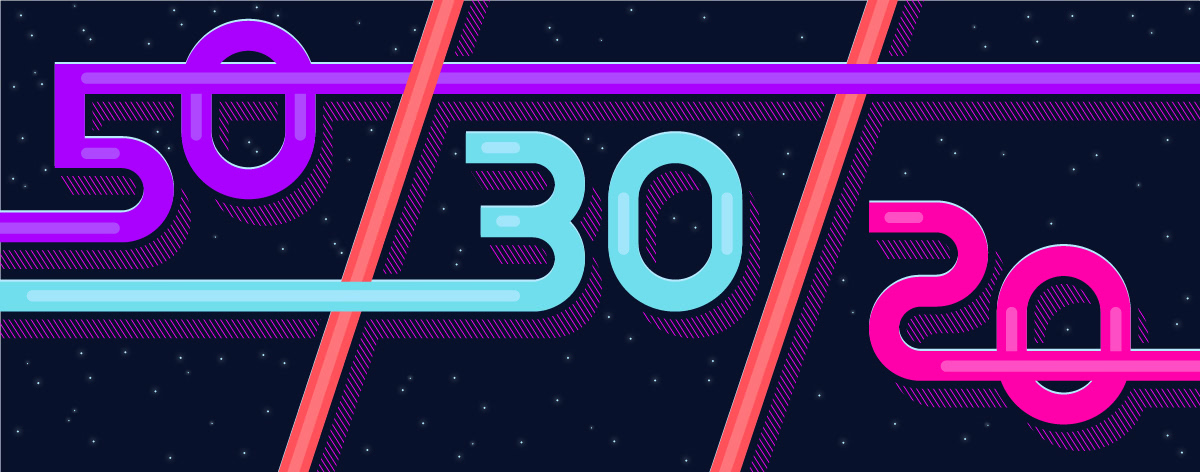

50/30/20 Rule to budgeting

Creating a simple budget that works for you is essential to financial wellness and freedom.

create a budget using the 50/30/20 RuleGet started.

Contact a MidWestOne Banker today to see how you can enroll for Overdraft Flex on your checking account.